Summary:

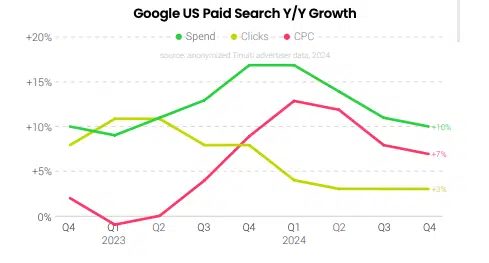

Google search spending rose 10% year-over-year in Q4 2024.

Click growth remained steady at 3%.

Cost per click (CPC) increased by 7%.

Performance Max now generates 67% of Google shopping ad revenue.

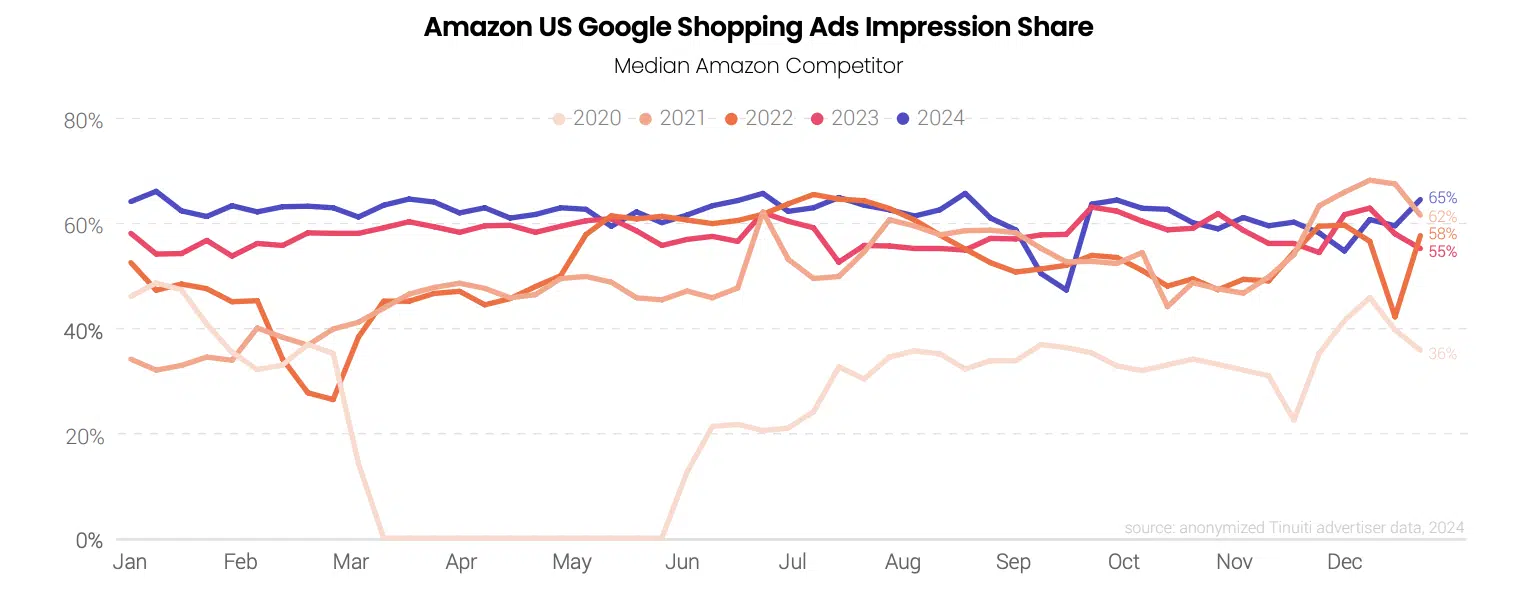

Amazon maintains a strong presence while Temu has reduced its ad presence.

Key Insights from the Latest Tinuiti Report

Advertisers are adapting to Google's AI-driven changes, which include the adoption of Performance Max and AI Overviews. According to the latest report from Tinuiti, here are the important numbers:

- Google search spending rose 10% year-over-year in Q4 2024.

- Click growth remained steady at 3%.

- Cost per click (CPC) increased by 7%.

- Microsoft search ad spending also grew by 7%, with CPC up 11%.

The Big Picture

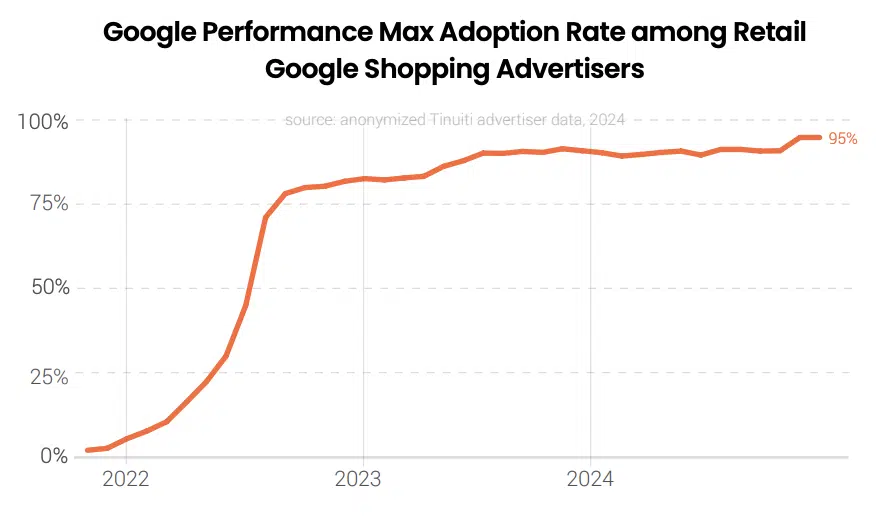

Performance Max continues to dominate Google’s shopping ad landscape, with over 95% of retailers adopting it by year-end 2024. This format now generates 67% of Google shopping ad revenue for retailers.

Why This Matters

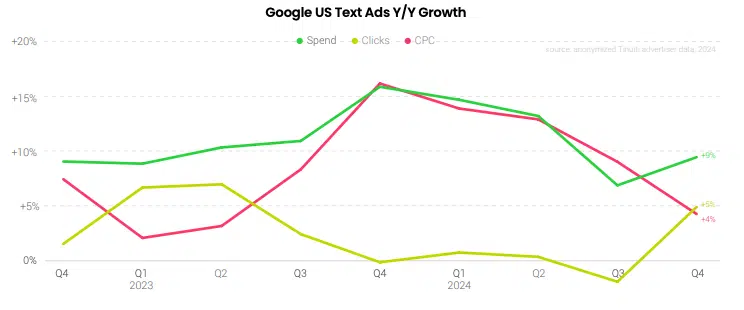

Google's push towards automation is yielding mixed results. While Performance Max has improved performance compared to standard shopping campaigns, the introduction of AI Overviews initially hurt click-through rates for text ads before seeing a rebound in Q4.

Competitive Landscape

- Amazon maintains a strong presence in Google shopping auctions.

- Temu has significantly reduced its Google shopping ad presence, dropping to minimal impression share.

What's Next

As Google continues to emphasize AI-driven ad solutions, advertisers will need to balance higher costs against improving performance metrics while adapting to new automated formats.

Comments

Join Our Community

Create an account to share your thoughts, engage with others, and be part of our growing community.